Permanent Loss Pt 1: Liquid Staking Tokens are Crypto's Treasuries

Part one of a series on Permanent Loss by Manny Rincon-Cruz, founder and protocol designer of Buttonwood & Poolside. Originally posted on Thinking Farm.

Introduction

The largest liquid asset classes are bonds, stocks, and derivatives. In 2022 the total value of all the world’s bonds, as estimated by the Bank for International Settlements, stood at $133 trillion. Equities’ global market capitalization was a close second at $98.5 trillion, while the gross value of the derivatives market was $20.7 trillion. But while stock market moves make the news, in terms of size, government debt issuers rule the roost. Today, US federal government debt stands at $33.7 trillion, making the US Treasury the king of the $51 trillion American bond market.

Just as Treasuries dominate traditional finance in the US, liquid staking tokens (LSTs) will dominate decentralized finance (DeFi). Fixed-income instruments–of which bonds are the largest and most important–are at the bottom of today’s financial food chain. The interest rate charged by the most reliable issuers serves as the “risk-free rate”, which markets reference as the price of capital, a lever used by central banks today to stimulate or throttle economic activity.

More importantly, fixed-income instruments, in large part have become the base of the modern financial food chain. Like sunlight-fed plankton and algae feed almost all other oceanic organisms, from krill, squid, and corals to fish, sharks, and whales, fixed-income yield nourishes higher financial organisms from banks and pension funds to exchanges and hedge funds. These might include nimble new startups like Meow, with $1B in assets, and giants like Blackrock with $9.1T.

Much like bonds, LSTs continuously produce “yield” in the form of these networks’ native gas token, which users need to pay for transactions. And much like oceanic algae and plankton, LSTs have the potential to feed an explosion of higher financial organisms on smart contract networks like Ethereum, Avalanche, and Solana.

LSTs are poised to become crypto Treasuries because they produce native yield through the most basic, useful activity on smart contract networks, which consists of securing the network against attacks and validating its transaction history. That’s as close as you can get to a “risk-free rate” of return on a blockchain as you can get.

DeFi’s resilience–Steady Lads

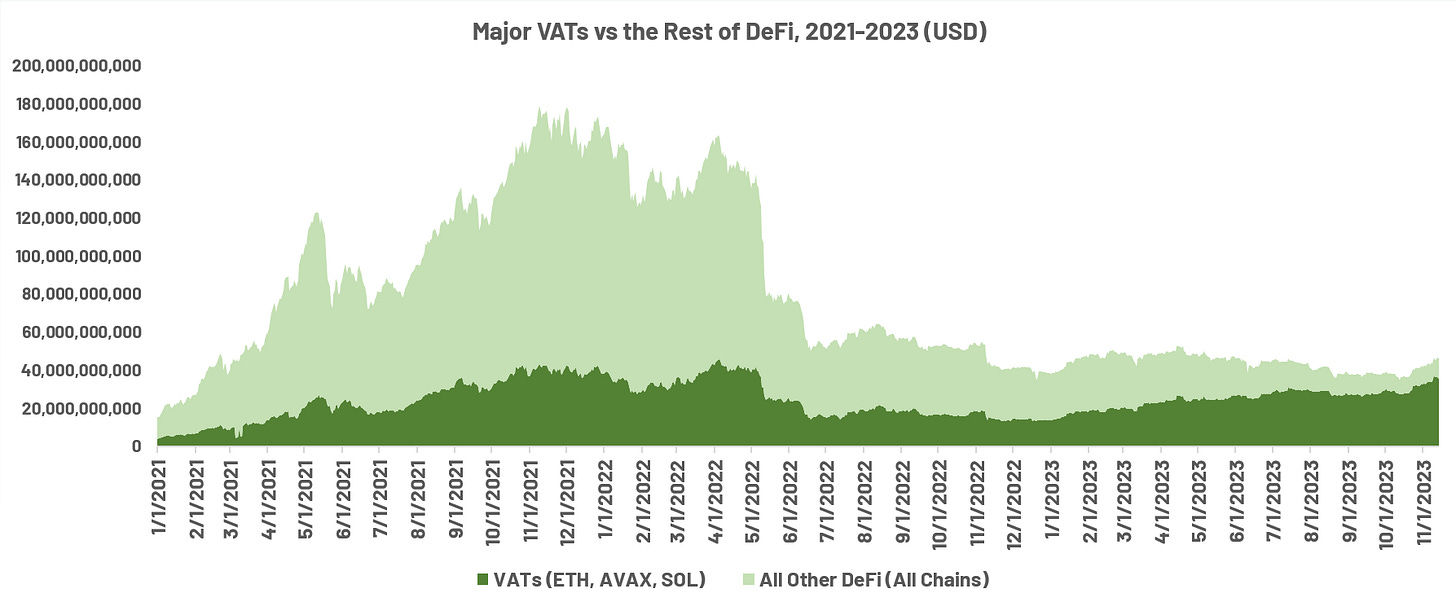

DeFi’s total value locked (TVL) has held somewhat steady at about $40B, standing at $46.7B as of November 14, 2023.

However, a more granular view reveals that a vast majority of DeFi TVL is now composed of yield-bearing assets in the form of value-accruing tokens (VATs).

After taking a hit in 2023, the total market value of VATs is now back to early 2022 levels, reaching $35B in November. Looking only at VATs on Ethereum, Avalanche, and Solana, VATs stand at an astounding 80% of all DeFi TVL!

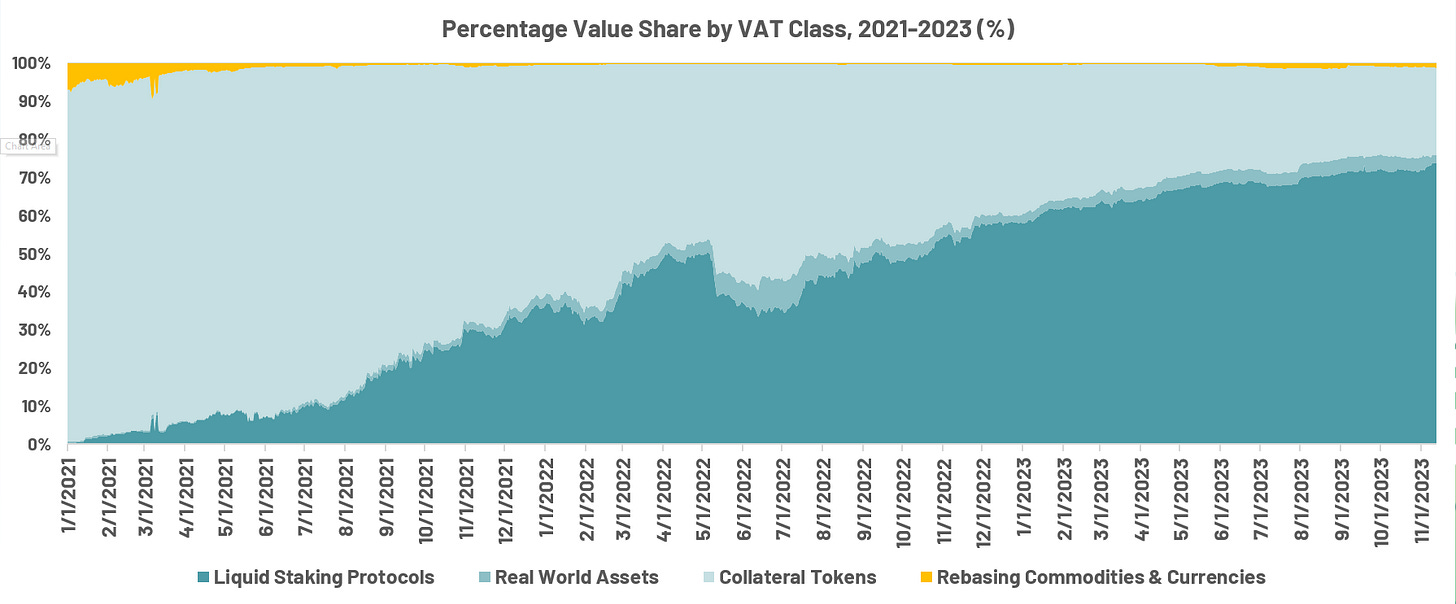

Many crypto teams have staked their future on the thesis that fixed-income instruments will similarly form the base of the DeFi food chain. They have focused on the tokenization of real-world assets (RWA), primarily Treasuries, corporate bonds, and mortgages. Surprisingly, despite the attractiveness of high-interest rates paid on government bonds, it is not RWAs or even collateralized lending positions that now dominate DeFi, but LSTs.

LSTs were worth $26.8B out of $36.4B in VAT total value, versus $747M for RWAs, $443M for rebasing commodities, and $8.3B for collateral tokens.

As of November 15, 2023, LSTs accounted for 76% of VAT market value, marking a new all-time high.

Understanding Value Accrual

What exactly are VATs? Value-accruing tokens are assets that are natively yield-bearing, meaning that the token’s returns are denominated in that same token or the same underlying asset. There are four important types of VATs, three of which accrue value from on-chain processes:

First are LSTs, which represent fungible shares of a network’s native “gas” token that have been staked for validation. LSTs allow retail users to delegate network-native tokens to a set of validators, who in turn put up these tokens as collateral to validate network transactions, earning both network fees and emissions for behaving appropriately and risking having their tokens slashed if they misbehave.

Second are collateral tokens from protocols like Aave and Compound. These tokens represent the lending positions that a user receives when they deposit collateral into Aave or Compound. The collateral goes into a pool which other users then borrow and in exchange, pay a floating interest rate.

Third are RWAs, such as the tokenized Treasury bills on Ondo and others. The value accrues from off-chain sources. In the case of tokenized bills, value accrues from the interest that the American government pays on the bonds which Ondo’s associated entities have purchased and hold off-chain.

Fourth are rebasing commodities and currencies like Ampleforth, SPOT, and Lybra’s eUSD. SPOT in particular, is very interesting–it is a robust, inflation-tracking “flatcoin.” It accrues value relative to the US dollar–SPOT’s value relative to the dollar increases at the same rate as inflation.

LSTs are Crypto’s Treasuries

What does it mean for an asset to be natively yield-bearing or for a token to bear its returns in that same token or the same underlying asset? A VAT is more like a modern government bond than a corporate stock. A stock is not redeemable for anything in particular, but it can pay owners a dividend in dollars, an exogenous asset earned through profitable economic activity. Meanwhile, a government bond requires that an investor lock up some dollars now for a promise that can be redeemed for more dollars in the future. After the 1971 break from the gold dollar standard, these future dollars are endogenous assets produced by the state, which is the bond issuer itself.

Smart contract networks like Ethereum provide infrastructure for peer-to-peer computation, which makes them an ideal platform for a new type of finance. By removing intermediaries from financial activity, smart contracts lower the costs of finance by one to two orders of magnitude, a potential already partly realized in the realm of crypto token trading. Removing intermediaries from financial activity also recovers, at least for Americans, Fourth Amendment protections, which had been severely curtailed through the Bank Secrecy Act.

How do these platforms work? Until September 15, 2022, Ethereum used a proof-of-work (POW) consensus mechanism to build its blockchain. Users submitted their desired transactions to a memory pool and paid a fee in ETH, Ethereum’s native token, and the consensus algorithm would pick a node to mine a “block” using these transactions. Nodes would compete with each other to mine the block by using large computer farms to solve a cryptographic puzzle. The winner would win the ETH fees and an additional ETH that was minted by the protocol as a reward.

However, Ethereum has now transitioned to a proof-of-stake (POS) model, in which validator nodes first stake at least 32 ETH to participate. A random selection mechanism then picks a node to build the next block, and a node’s probability of being selected is proportional to their share of all staked ETH. The winner then gets to “build” instead of mine the next block and wins a portion of the ETH fees paid by users, while a portion of that ETH is burned. No new ETH is minted in this process, making ETH deflationary relative to the volume of transactions it processes.

Liquid staking protocols are a non-custodial way for users to deposit their ETH and participate in staking without running a node or owning 32 ETH. Instead, their ETH is algorithmically delegated to a network of nodes who do the staking. The protocol nodes take a 10% service cut of the 3.25% ETH yield currently earned from staking ETH, leaving about 2.93% for users. A user that has deposited ETH will receive an LST in return. In the case of Lido, for example, a user exchanges ETH for stETH, which will rebase as rewards accrue, allowing stETH to maintain a 1:1 redemption ratio with ETH.

Conclusion

I believe LSTs are poised to become crypto Treasuries because they are a means of producing ETH-native yield through economically useful activity–which in this case consists of securing the Ethereum network against attacks and validating its transaction history.

Liquid staking is, at its core, the on-chain financialization of smart contract security itself. It allows a smart contract network platform to perpetually produce an endogenous asset with real value. It is as if Bitcoin users could freely invest in Bitcoin mining themselves. This native yield is a powerful engine for DeFi, fueling a food chain of financial activity from lending and borrowing, to tranching and hedging. Whither go VATs, so goes DeFi.

Special thanks for comments, edits, and feedback to Yissey, Matthew Fisher, Fiddlekins, and Brandon Iles. Originally posted on Thinking Farm.